If earning net cash flow from rental real estate was an easy thing to do, everyone would be doing it. It’s a simple, straight forward business model, but it’s not easy. This skill requires knowledge and real work in the business realm.

Business is a space lots of people work inside but many folks only touch certain parts of a business model. Accounting, or marketing, or finance. Yet to earn positive cash flow each month from your rentals this implies you understand the whole model and thus are a good entrepreneur.

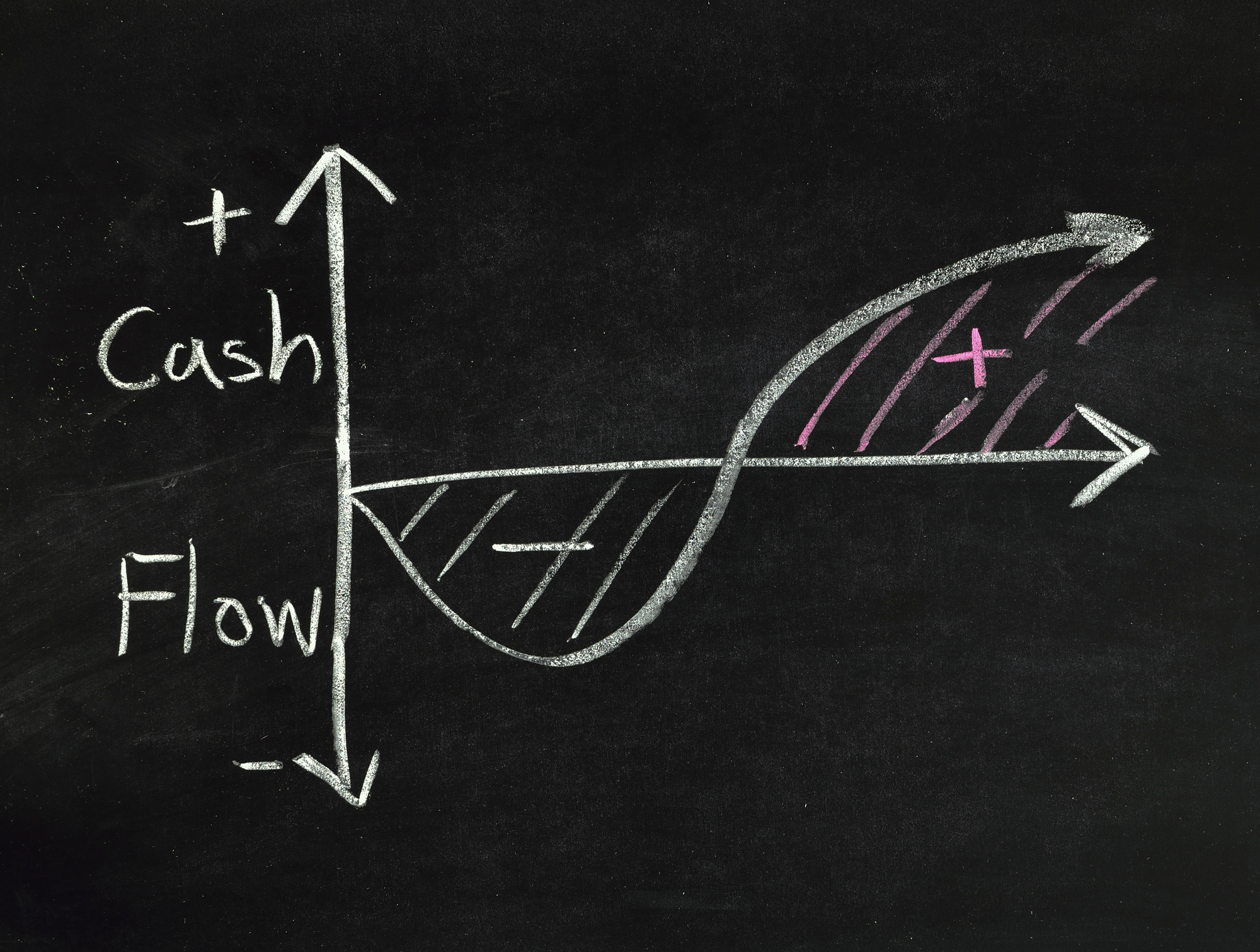

The real estate business is lumpy, as is life. Some months are great and nothing bad in the maintenance world happens. Other months you have turnover and maintenance requests. Thus is the nature of business – lumpy.

I always remember myself whenever I feel stressed – this business is evergreen. People will always need a place to live.

Looking forward from an economic perspective, there’s going to be an affordability problem in real estate. That means more people are going to elect to rent because they can’t afford to buy.

Additionally, the rise of remote work is allowing workers the opportunity to spend a few months in certain geographies then move to a new city whenever they feel like it. This is possible because remote workers aren’t locked down to a physical local i.e. the office. They live and work online.

This is remote work trend is such a fantastic development in the modern world. It’s great for workers. Why? They now have more flexibility, optionality, and freedom to live and work as they please. That’s a huge LQ improvement from generations past where those workers basically worked their entire lives then died without any time off. Now-a-days we can sit down all day (or use a stand desk if you’re smart) and work. I would wager any industrial worker from decades past would trade places with modern day worker’s conveniences and air conditioned offices.

Personal Finance & LQ Pulse Check

From a high level view, my personal finances are strong in every area. My credit score is in the 800’s. I have at least 3 months of personal expenses saved. I have 6 months of PITI saved across my rental portfolio. I have a paper asset portfolio closing in on six figures. I have 1K of student debt left which is 6 more payments! I am closing on my first BRRRR property today within 25 minutes of my office. Not to mention within 30 minutes of any big city attraction I want to enjoy – networking events, digital marketing meet ups, singles, music shows, the bar scene (lame), sports. My LQ is going to drastically improve through winter.

The peace of mind in having loads of liquid money saved cannot be overstated. If anything were to happen to my employer (out of my control), the industry (out of my control), the world (covid) I have at least 6 months of time I’ve bought myself to adapt to my new reality. This liquidity piece is key toward building wealth over time. You must be flexible and adaptable while you operate from a position of financial strength. You must jump on business opportunities when they crop up.

It’s a fact the majority of people are living paycheck to paycheck, even the high income earners. These are the sorts of folks who believe get-rich-quick actually works. Building wealth is a gradual, slow process requiring patience and discipline. That’s NOT sexy, which is why so few human’s truly build real wealth in their lifetime.

I’m here to tell you the process is absolutely worth it. It’s going to feel very lonely at times because most people are flat broke. Most people simply can’t relate to you. This is a good sign people.

The path to the top is always lonely because FEW people are at the top. Paradoxically, not everyone can get to the top because there simply isn’t enough room for everyone. Some people will always have more than others and some people will always have less. Welcome to capitalism. It may not be a perfect economic system but it’s the best system the world has created thus far.

A key in advancing yourself up the wealth pyramid is to never give up. If two people start out on the same path at the same time but one person gives up after 5 years while the second person never stops, it’s obvious the second person will win. Even if that second person has a negative net worth after five years that fact they did not stop executing their money habits will drastically improve the probability they will succeed in the long term. Just don’t stop. You owe it to yourself and your family.

An analogy: My rescue German Shepard (whom I adore – great companion) always tracks and chases squirrels. It’s her god given duty on this planet to defend the property perimeter from squirrels. To this day, she has never caught a squirrel. She hasn’t even come close – but she doesn’t stop. She knows if she were to stop, she’ll never achieve her goal of capturing a squirrel. Maybe she’ll never catch one, and you know, that’s OK. It’s the fact this rescue dog always went after her goal every day, never giving up, which provides her a sense of duty and purpose in life. That fulfillment ensure she will die peacefully one day knowing she gave it her all, each day, going after her dream of catching a squirrel.

Are you trying to catch your own squirrel? Or are you too preoccupied using social media for personal use?